Categories

Categories

Authors

Authors

The Small and Medium Enterprise Ecosystem in Ethiopia: The Impact of Innovative Finance for improvement of the Manufacturing Sector bY Ajebush Shafi and Mammo Muchie (HB)

The Small and Medium Enterprise Ecosystem in Ethiopia: The Impact of Innovative Finance for improvement of the Manufacturing Sector bY Ajebush Shafi and Mammo Muchie (HB)

Product Description

Small and Medium Manufacturing Enterprises face many barriers. Some barriers arise from government regulations that disproportionately hamper SMEs form performance. However, there are also barriers inherent in markets that affect enterprises because of their size. These barriers we call “size-induced market failures” and they occur in the key areas that affect enterprise competitiveness. Failures in the markets for credit, technology, and skilled workers, along with difficulty in accessing domestic and international markets, are the main areas for concern. Information asymmetries in some markets, notably for finance, are a major obstacle, as are the disproportionately higher costs that SMEs face in accessing credit and other markets.

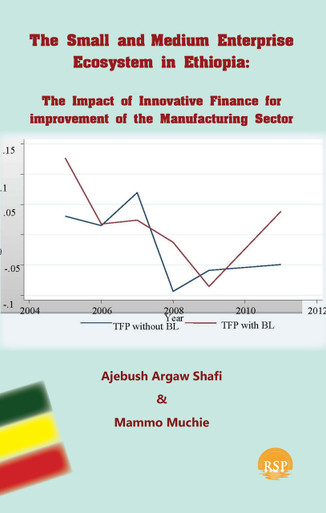

In this book the authors have designed comprehensive empirical studies and identified the impacts of access to finance on the Small and Micro Enterprises (SMEs) performance. The authors applied a mix of different methodologies ranging from developing a conceptual framework to an empirical study to investigate how, and to what extent, access to finance influences Small and Micro Enterprises (SMEs) performance. The motivation for the study was that the link between SMEs performance and use of bank credit is inconclusive. The study helps to understand the developed world financial theory and developing countries actual situation; thus, it helps to bridge the gap between theory and practices and strategically inform business decisions. It also helps to micro business owners to think and choose whether to engage in borrowing from the bank or not; and to choose the right financing sources for their micro firms by considering the risk of borrowing from banks ahead. Furthermore, the study could be an important source of scientific evidence to stakeholders and policy makers. It will be also a basis for future studies on understanding SMEs and financing dynamics.

About the Authors

Ajebush Argaw Shafi, PhD, has been a Post-Doc in the DSI/NRF SARChI chair in Innovation Studies and is currently affiliated as a Research Associate with the SARChI chair in Industrial engineering Department Tshwane University of Technology, Pretoria, South Africa

Mammo Muchie, professor, is a DST/NRF Rated Research Professor in Innovation Studies at the Department of Industrial Engineering at the Faculty of Engineering and Built Environment in Tshwane University of Technology (TUT) in Pretoria, South Africa. He is also NRF Rated Research professor and member of the African Academy of Sciences and the South African Academy of Sciences.

World Rights

Category: Economy, Small Scale Manufacturing, Finance/AFRICA

Page count: 248

Trim size: 5.5x 8.5

Publication Date: 2021

Loading... Please wait...

Loading... Please wait...